Scenario

This specification applies to recurring payments of irregular amounts initiated by the merchant. For the initial transaction, the buyer is required to enter their credit card information and complete 3D Secure authentication. For subsequent transactions, the timing and checkout interface can be designed at the merchant’s discretion.

![]() Special note:The first time a credit card is bound, a 3D Secure authentication will be performed. However, if the consumer’s credit card does not support 3D Secure, the binding process can still be completed. If the merchant wishes to mandate 3D Secure authentication for all card bindings, they can request the activation of the “Absolute 3D” feature from Greenworld’s business unit. This feature will block credit cards that do not support 3D Secure from being bound.

Special note:The first time a credit card is bound, a 3D Secure authentication will be performed. However, if the consumer’s credit card does not support 3D Secure, the binding process can still be completed. If the merchant wishes to mandate 3D Secure authentication for all card bindings, they can request the activation of the “Absolute 3D” feature from Greenworld’s business unit. This feature will block credit cards that do not support 3D Secure from being bound.

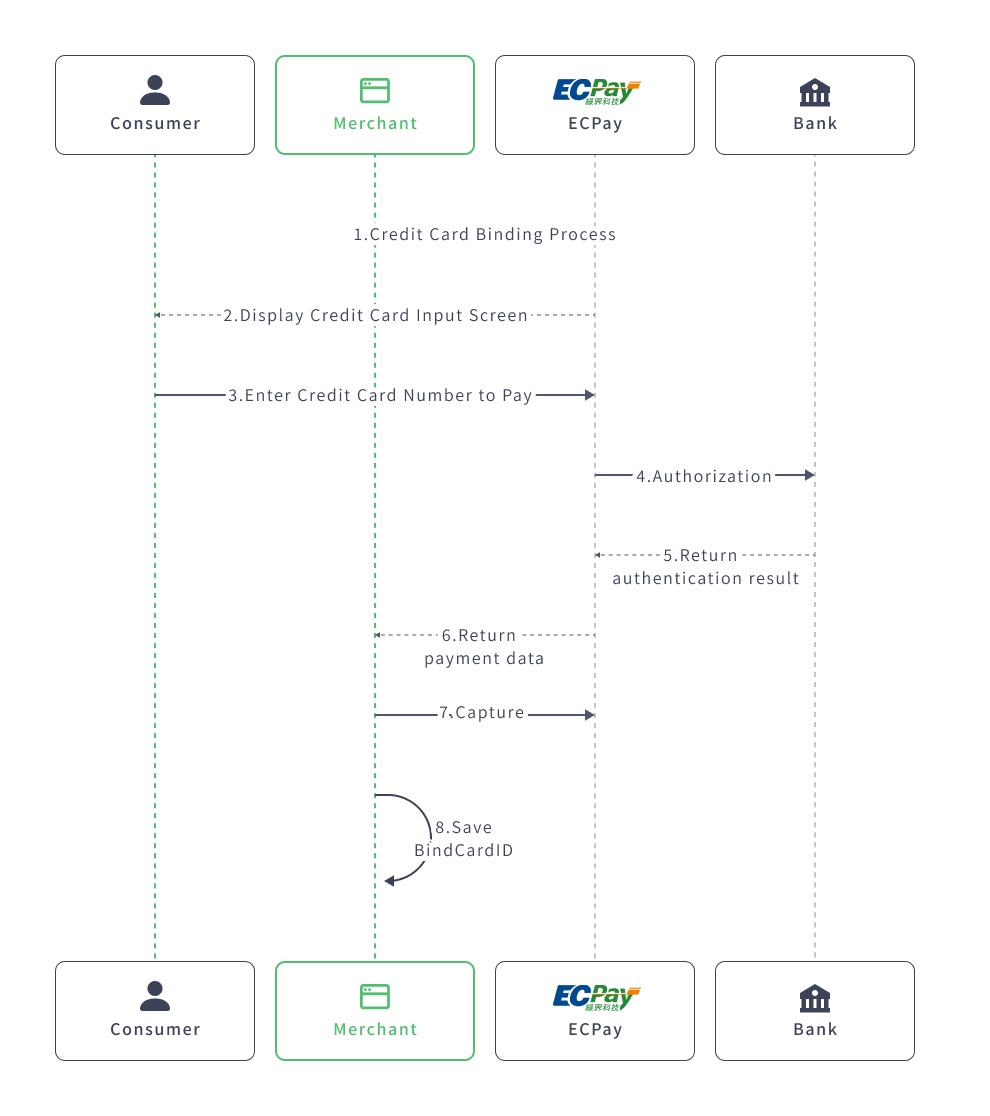

Scenario 1 : First Transaction and Credit Card Binding

- The merchant performs the transaction and card binding process, proceeding with checkout.

- ECPay displays the card number transaction screen.

- The consumer enters the card number to proceed with payment.

- ECPay sends the transaction authorization request to the bank for verification.

- The bank replies with the authorization result.

- ECPay returns the transaction authorization result and bound card number code to the merchant.

- The merchant completes the authorisation capture to ensure the transaction is successful .

- The merchant records the bound card number using the member ID.

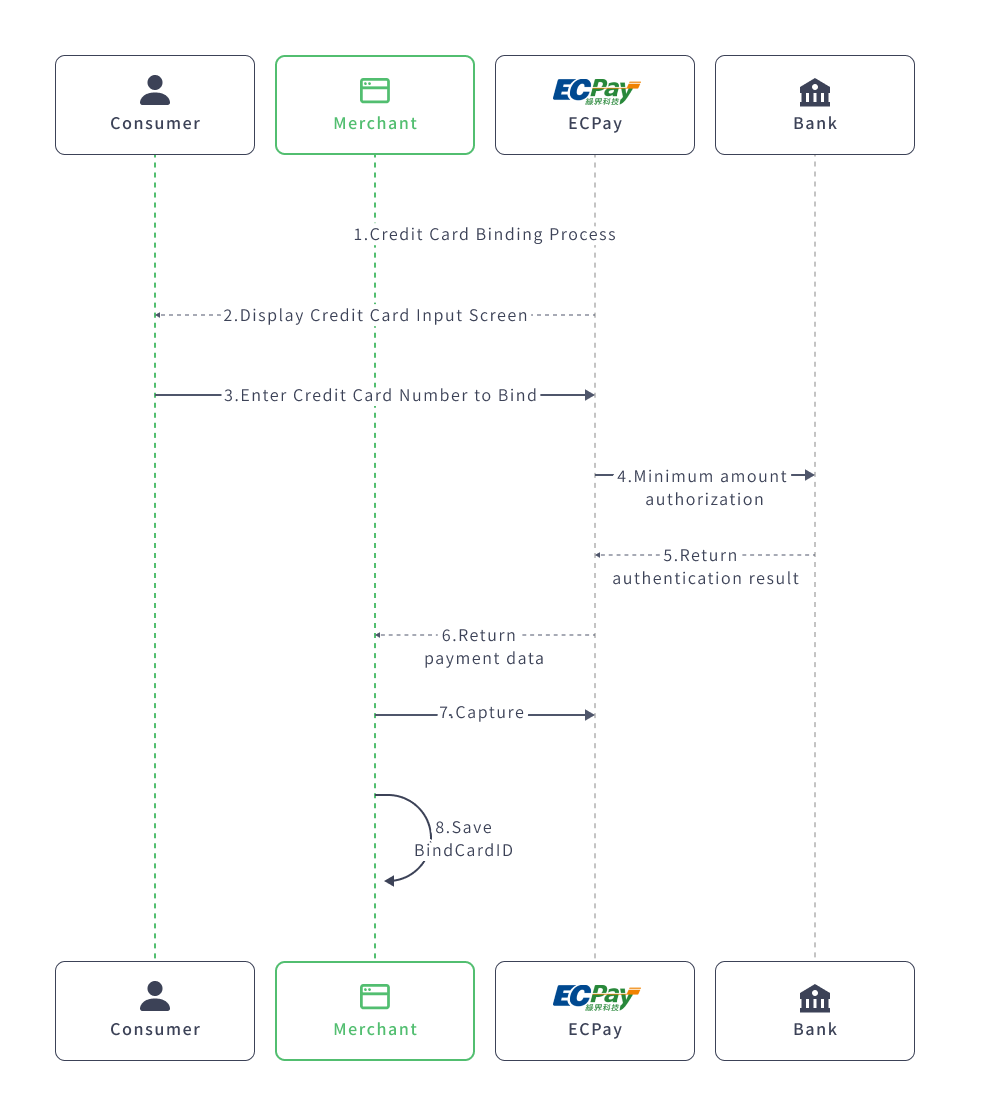

Scenario 2: Merchant Performs Transaction and Credit Card Binding with Minimum Transaction Authorization

- The merchant proceeds with the transaction and card binding process, performing the authorization for the merchant’s minimum transaction amount.

- ECPay displays the card number transaction screen.

- The consumer enters the card number to make the payment.

- ECPay sends the transaction authorization request to the bank for verification.

- The bank replies with the authorization result.

- ECPay returns the transaction authorization result and the bound card number to the merchant.

- The merchant calls the credit card refund function to cancel the minimum transaction amount authorization.

- The merchant records the bound card number using the member ID.

![]() Special note: Some banks prohibit using the same credit card number for transactions within a short period. If the BindCardID is obtained and a second transaction authorization is required, there must be a 35-second gap between the two transactions to avoid the second authorization being blocked by the bank. Alternatively, the integration method in Scenario 1, where the transaction and card binding are performed simultaneously, can be used.

Special note: Some banks prohibit using the same credit card number for transactions within a short period. If the BindCardID is obtained and a second transaction authorization is required, there must be a 35-second gap between the two transactions to avoid the second authorization being blocked by the bank. Alternatively, the integration method in Scenario 1, where the transaction and card binding are performed simultaneously, can be used.

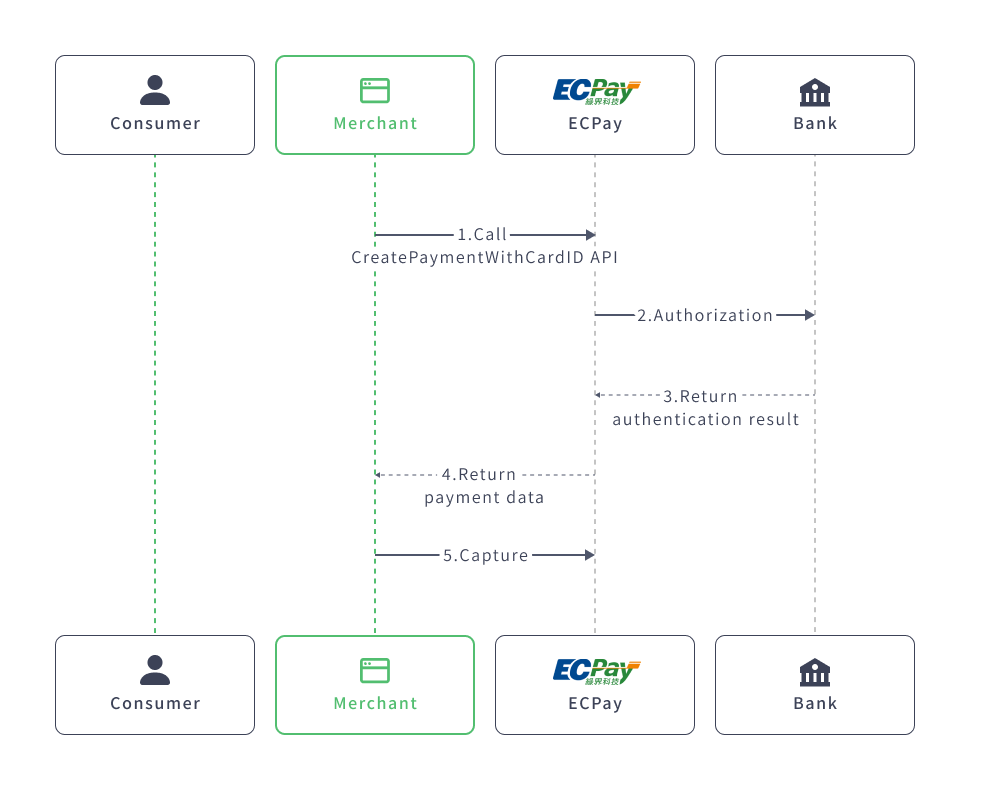

Scenario 3: Second Transaction After Successful Credit Card Binding

- The merchant calls the backend transaction authorization to process the transaction authorization.

- ECPay sends the transaction authorization request to the bank for verification.

- The bank replies with the authorization result.

- ECPay returns the transaction authorization result to the merchant.

- The merchant completes the authorisation capture to ensure the transaction is successful.

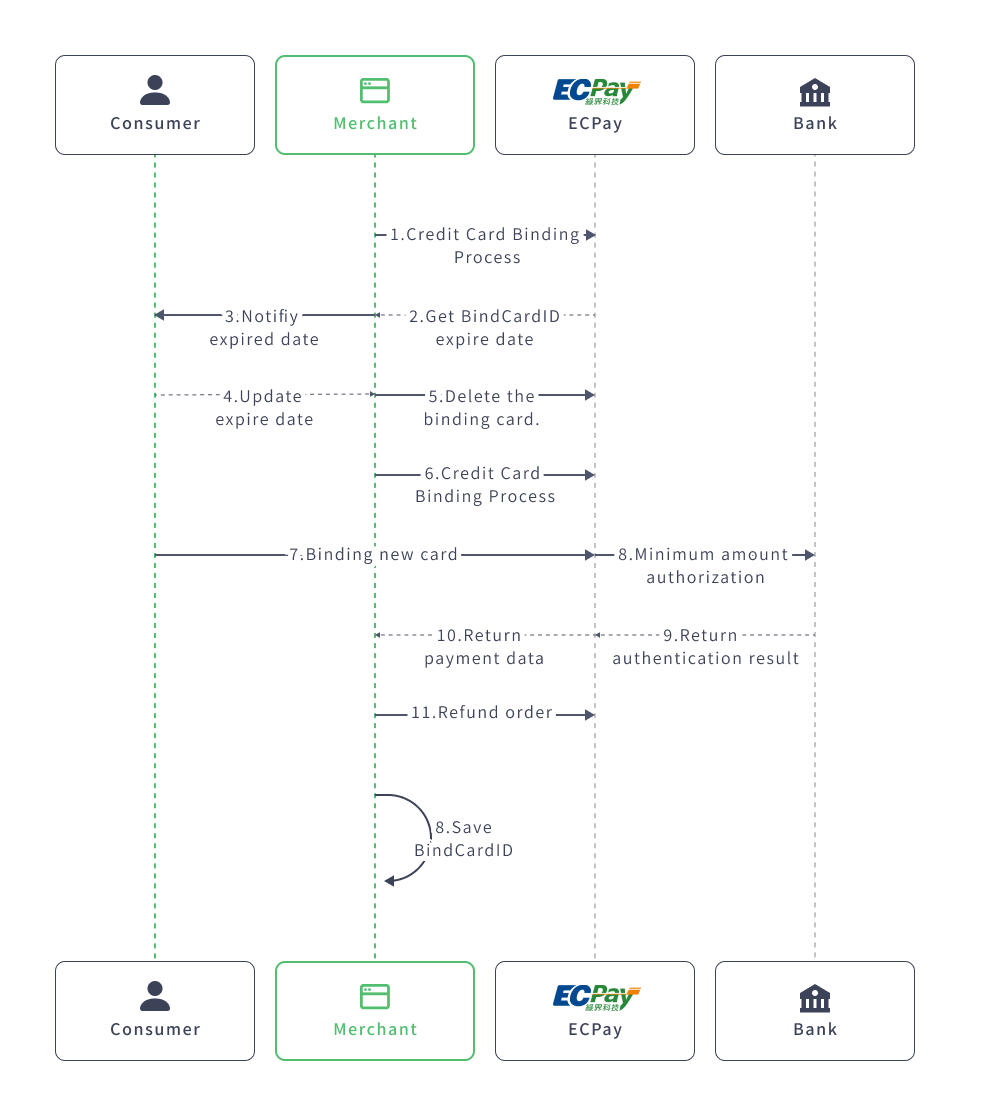

Scenario 4: Rebinding Credit Card After Expiration

- The merchant proceeds with the transaction and card binding process.

- After successful binding, the merchant receives the BindCardID and the expiration date of the credit card, and records the BindCardID and expiration date.

- Before the BindCardID expiration date, the merchant sends a notification to the member, informing them that their bound credit card is about to expire and prompting them to update their binding.

- The member agrees to update the binding.

- The merchant calls ECPay’s API to delete the bound credit card.

- The merchant proceeds with the transaction and card binding process again.

- The consumer enters the card number for payment.

- ECPay sends the transaction authorization request to the bank for verification.

- The bank replies with the authorization result.

- ECPay returns the transaction authorization result, BindCardID, and credit card expiration date to the merchant.

- The merchant calls the credit card refund function to cancel the authorization.

- The merchant records the new BindCardID and expiration date.