Application Scenarios

This API provides the function of searching a particular e-invoice. Merchants can search either by RelateNumber or by InvoiceNo.

If you have a large number of inquiries, we recommend using Searching multiple E-invoice。

API URLs:

- Stage: https://einvoice-stage.ecpay.com.tw/B2CInvoice/GetIssue

- Production: https://einvoice.ecpay.com.tw/B2CInvoice/GetIssue

HTTPS format

- Content Type :application/json

- HTTP Method :POST

Request by Merchant (Json format)

PlatformID String(10)

- This parameter is specifically designed for platform vendors collaborating with ECPay. It can only be utilized after applying for and activating the service.

- If you are a general vendor, please leave the PlatformID empty.

- When using this parameter, the MerchantID must be filled in with the specific store code bound to your PlatformID to prevent operation failures.

- Please note that only the MerchantID of a bound sub-merchant can be used to avoid operational failures. For binding operations, please contact your business representative.

MerchantID String(10)

Required

RqHeader Object

Required

Request header

Timestamp Number

Required

- Please convert the transmission time to a timestamp (GMT+8).

- ECPay will use this parameter to convert the current time to Unix TimeStamp to verify the time interval of this connection.

![]() Special Notes:

Special Notes:

- If ECPay receives the API call more than 10 minutes after the timestamp sent by merchants, this request will fail. Reference information is as follows:http://www.epochconverter.com/。

- Merchants are advised to frequently synchronize their server’s time to the nearest time zone server.

Data String

Required

- Message payload

- This is the encrypted data in JSON format.

AES Encryption Description

Example

{

"MerchantID": "2000132",

"RqHeader": {

"Timestamp": 1525168923

},

"Data": "..."

}

Scenario 1 : search by RelateNumber

Message payload of Data (JSON format): please urlencode the JSON string first and then do AES encryption

MerchantID String(10)

Required

RelateNumber String(50)

Required

- Unique ID of the e-invoice which is defined by the merchant itself.

Example

{

"MerchantID": 2000132,

"RelateNumber": "20181028000000020",

}

Scenario 2 : search by InvoiceNo and InvoiceDate

Message payload of Data (JSON format): please urlencode the JSON string first and then do AES encryption

MerchantID String(10)

Required

InvoiceNo String(10)

Required

Number of e-invoice

InvoiceDate String(10)

Required

- Date of e-invoice created

- The format: yyyy-MM-dd

Example

{

"MerchantID": 2000132,

"InvoiceNo": "AA123456",

"InvoiceDate": "2018-10-28"

}

Response format

- Content Type :application/json

- HTTP Method :POST

Response by ECPay (Json format)

PlatformID String(10)

MerchantID String(10)

Required

Response header

Timestamp Number

Unix timestamp(GMT+8)

TransCode Int

- Response code to indicate whether the payload is successfully accepted

- Possible values:

1: Payload (i.e. MerchantID, RqHeader, and Data) is successfully accepted by ECPay.

Others: failed.

TransMsg String(200)

Response message to indicate whether the payload is successfully accepted

Data String

- Message payload

- Respond with relevant data, this is the encrypted JSON format data.

AES Encryption Description

Example

{

"MerchantID": "2000132",

"RpHeader": {

"Timestamp": 1525169058

},

"TransCode": 1,

"TransMsg": "",

"Data": "..."

}

Message payload of Data (JSON format): please do AES decryption to the Data first and then perform urldecode

RtnCode Int

- Return codes to indicate whether the API is successfully executed or not.

- Possible values:

1: API is successfully executed.

Others: failed.

RtnMsg String(200)

Return messages indicating whether the API is successfully executed or not.

IIS_Mer_ID String(10)

Merchant ID

ChannelPartner String(1)

1:Shopee

IIS_Number String(10)

E-Invoice number

IIS_Relate_Number String(50)

Unique ID of the e-invoice

IIS_Customer_ID String(20)

Customer code

IIS_Identifier String(10)

- Buyer Tax ID

- 0000000000 implies that there is no Tax ID

IIS_Customer_Name String(60)

- Customer name

- Will be output in the form of URL Encode coding

IIS_Customer_Addr String(100)

- Customer address

- Will be output in the form of URL Encode coding

IIS_Customer_Phone String(20)

Customer Phone Number

IIS_Customer_Email String(80)

Customer E-mail

IIS_Clearance_Mark String(1)

- Clearance Method

- 1: Export not via custom

2: Export via custom

IIS_Type String(2)

- Invoice category

- 07: General tax amount calculation

IIS_Category String(10)

- Invoice category

- B2B: Indicates that the invoice is issued with Tax ID.

B2C: Indicates that the invoice is issued without Tax ID.

IIS_Tax_Type String(1)

- Tax category

- 1: Should be taxed

2: Tax rate is zero

3: Duty Free

4: Special tax computation

9: If it is combined tax rate, zero tax or duty free

ZeroTaxRateReason String(2)

The valid values are as follows:

71: (Item 1) Exported goods

72: (Item 2) Export-related services or services provided domestically but used abroad

73: (Item 3) Sales by duty-free shops established in accordance with the law to transit or outbound passengers

74: (Item 4) Sales of goods or services to enterprises in bonded zones for operational use

75: (Item 5) International transportation services. However, for foreign transportation enterprises operating international transport services within the Republic of China, such services are limited to those granted reciprocal treatment or tax exemption by their home countries

76: (Item 6) Vessels, aircraft, and deep-sea fishing boats used for international transportation

77: (Item 7) Sales of goods or repair services for vessels, aircraft, and deep-sea fishing boats used for international transportation

78: (Item 8) Sales by bonded zone enterprises to taxable zone enterprises where the goods are directly exported without entering the taxable zone

79: (Item 9) Sales by bonded zone enterprises to taxable zone enterprises where the goods are stored in Free Trade Zone enterprises or customs-controlled bonded warehouses/logistics centers for export purposes

SpecialTaxType String(1)

- Special Tax Type

- If [TaxType] is 1/2/9, please fill in 0.

- If [TaxType] is 3, please fill in 8.

- If [TaxType] is 4, and the parameter is required.

- The parameter can fill in 1-8.

- 1:Saloons and tea rooms, coffee shops and bars offering companionship services:Tax rate is 25%.

2:Night clubs or restaurants providing entertaining show programs: Tax rate is 15%.

3:Banking businesses, insurance businesses, trust investment businesses, securities businesses, futures businesses, commercial paper businesses and pawn-broking businesses: Tax rate is 2%.

4:The sales amounts from reinsurance premiums shall be taxed at 1%.

5:Banking businesses, insurance businesses, trust investment businesses, securities businesses, futures businesses, commercial paper businesses and pawn-broking businesses: Tax rate is 5%

6:Core business revenues from the banking and insurance business of the banking and insurance industries (Applicable to sales after July 2014): Tax rate is 5%.

7:Core business revenues from the banking and insurance business of the banking and insurance industries (Applicable to sales after June 2014): Tax rate is 5%.

8:Duty free or non-output data.

IIS_Tax_Rate Number

- Tax rate

- Up to 2 decimal places

IIS_Tax_Amount Int

- Tax

- Tax will be returned when the invoice has Tax ID.

- When the invoice is not issued with Tax ID, tax is included in the invoice amount and not calculated separately, so the return value is 0.

IIS_Sales_Amount Int

E-Invoice amount

IIS_Check_Number String(4)

E-Invoice check digit

![]() Special notes : This parameter is deactivated, please ignore the return value of this parameter

Special notes : This parameter is deactivated, please ignore the return value of this parameter

IIS_Carrier_Type String(1)

- Carrier type

- 1: A Green World E-Invoice carrier

2: Is customer’s citizen digital certificate

3: Is customer’s cellphone number

※If no carrier, then it is a blank value.

IIS_Carrier_Num String(64)

- Carrier code

- If no carrier, then it is blank value

- If it is a ECPay E-Invoice carrier, then it is the merchant’s carrier Tax ID + custom code (RelateNumber)

- If customer’s carrier is their citizen digital certificate, the format should be two 2 alphabet character in addition to 14 numerical digits (Total length of 16 unites)

- If customer’s carrier is their cellphone number, then its total length should be 8 units, sequence format of 1 code slash “/” followed by a sequence of 7 numerical digits, cap-sized alphabets and +-. symbols.

IIS_Love_Code String(7)

- Donation party Donation code

- Ministry of Finance -Search for donated organization or group’s donation code

https://www.einvoice.nat.gov.tw/APMEMBERVAN/XcaOrgPreserveCodeQuery/XcaOrgPreserveCodeQuery

IIS_IP String(20)

E-Invoice Issuance IP

IIS_Create_Date String(20)

- E-Invoice issuance time

- Format is “yyyy-MM-dd HH:mm:ss”.

IIS_Issue_Status String(1)

- E-Invoice Issuance status

- 1: E-Invoice Issued

0: E-Invoice invalidated

IIS_Invalid_Status String(1)

- E-Invoice invalidation status

- 1: Have been invalidated

0: Not yet invalidated

IIS_Upload_Status String(1)

- E-Invoice upload status

- 1: Upload complete

0: Not yet uploaded

IIS_Upload_Date String(20)

- E-Invoice upload time

- Format is “yyyy-MM-dd HH:mm:ss”.

IIS_Turnkey_Status String(1)

- Reception status after E-Invoice uploaded

- C: Success

E: Failure - When IIS_Upload_Status = 0 (Not Uploaded),

IIS_Turnkey_Status will have no value.

When IIS_Upload_Status = 1 (Uploaded),

IIS_Turnkey_Status may be C (Success) or E (Failure).

IIS_Remain_Allowance_Amt Int

Remaining amount of allowance

IIS_Print_Flag String(1)

- Print flag

- 1: Print

0: Do not print

IIS_Award_Flag String(1)

- Winning flag

- Blank value: Did not check, cannot check (Such as: Donated E-Invoice)

0: Did not win

1: Won

X: E-Invoice with Tax ID

IIS_Award_Type String(2)

- Type of winning lottery

- Possible values:

12: Cloud E-Invoice Prize NTD 800

11: Cloud E-Invoice Prize NTD 500

10: Cloud E-Invoice Prize NTD 1 million

9: Cloud E-Invoice Prize NTD 2000

8: Bonus Prize NTD 10 million

7: Special Prize NTD 2 million

1: 1st Prize NTD 200000

2: 2nd Prize NTD 40000

3: 3rd Prize NTD 10000

4: 4th Prize NTD 4000

5: 5th Prize NTD 1000

6: 6th Prize NTD 200

0: Did not win

ItemSeq Int

Item Sequence Number

ItemName String(500)

- Item Name

- 1.The parameter shall be exempted when calculating the check digit

2.Will be output in the form of URL Encode coding

ItemCount Number

- Merchandise quantity

- It could be up to 8 integers and 7 decimals after the decimal point.

ItemWord String(6)

- Merchandise units

- 1.The parameter shall be exempted when calculating the check digit

2.Will be output in the form of URL Encode coding

ItemPrice Number

Merchandise price

ItemTaxType String(1)

- Merchandise tax category

- 1: Should be taxed

2: Tax rate is zero

3: Duty Free

![]() Special notes :

Special notes :

- Preset is an empty string, when the tax category [TaxType] = 9, this parameter cannot be null.

- When [TaxType]=9, [ItemTaxType] will need to discern the tax rate of each merchandise, amongst them should be at least 1 item that is 1(To be taxed) and another as 2(Duty Free) or 3(Tax rate is zero). Implying the combined tax rate E-Invoice can only be: 1|3(To be taxed and Duty Free) or 1|2(To be taxed and tax rate is zero).

ItemAmount Number

Merchandise total amount

ItemRemark String(120)

- Merchandise notation explanation

- If the parameter is not brought along or does not have value, the preset is blank

- The parameter shall be exempted when calculating the check digit

- Will be output in the form of URL Encode coding

IIS_Random_Number String(4)

Four-digit random number (effective from 2014-01-01)

InvoiceRemark String(200)

- E-Invoice Notation

- The parameter shall be exempted when calculating the check digit

- Will be output in the form of URL Encode coding

PosBarCode String(Max)

- Used for displaying the electronic invoice BARCODE. (This return parameter is for POS vendors only.)

- POS vendors must develop their own invoice templates and must apply to ECPay for authorization before use.

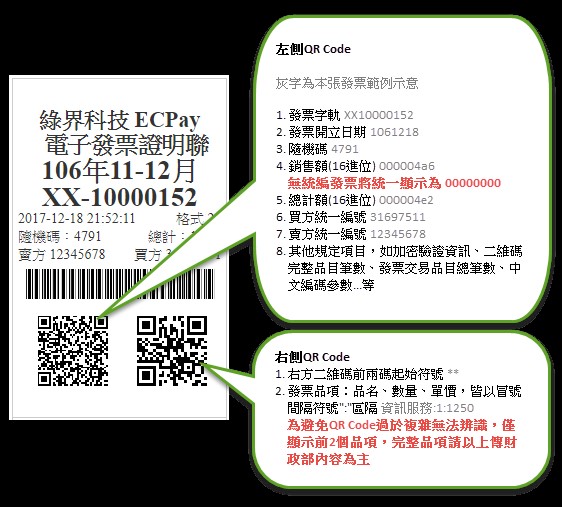

QRCode_Left String(Max)

- Used for displaying the left side of the electronic invoice QR Code. A password seed must first be configured with ECPay to enable encrypted data return. (This return parameter is for POS vendors only.)

- POS vendors who wish to develop their own invoice templates must apply to ECPay for authorization before use.

QRCode_Right String(Max)

- Used for displaying the right side of the electronic invoice QR Code. A password seed must first be configured with ECPay to enable encrypted data return. (This return parameter is for POS vendors only.)

- POS vendors who wish to develop their own invoice templates must apply to ECPay for authorization before use.

![]() Notes:

Notes:

To prevent the QR Code from becoming too complex and unreadable, it will display only the first two product items. For the complete list of product items, please refer to the data uploaded to the Ministry of Finance.

Example

{

"IIS_Mer_ID": "2000132",

"ChannelPartner": "",

"IIS_Number": "UV11100012",

"IIS_Relate_Number": "20181028000000020",

"IIS_Customer_ID": "",

"IIS_Identifier": "0000000000",

"IIS_Customer_Name": "Name",

"IIS_Customer_Addr": "Address",

"IIS_Customer_Phone": "",

"IIS_Customer_Email": "test@ecpay.com.tw",

"IIS_Clearance_Mark": "",

"IIS_Type": "07",

"IIS_Category": "B2C",

"IIS_Tax_Type": "1",

"IIS_Tax_Rate":0.050,

"IIS_Tax_Amount": 0,

"IIS_Sales_Amount": 100,

"IIS_Check_Number": "P",

"IIS_Carrier_Type": "",

"IIS_Carrier_Num": "",

"IIS_Love_Code": "0",

"IIS_IP": "0",

"IIS_Create_Date": "2019-09-17 17:17:31",

"IIS_Issue_Status": "1",

"IIS_Invalid_Status": "0",

"IIS_Upload_Status": "0",

"IIS_Upload_Date": "",

"IIS_Turnkey_Status": "",

"IIS_Remain_Allowance_Amt": 0,

"IIS_Print_Flag": "1",

"IIS_Award_Flag": "",

"IIS_Award_Type": "",

"IIS_Random_Number": "6866",

"IIS_Comment": "note",

"QRCode_Left": "UV111000121080917686600000000000000640000000011456006Sxys2hDhHuVVGnbc7XhCOg==:**********:2:3:1:item01:1:50:",

"QRCode_Right": "**item02:1:20",

"PosBarCode": "10810UV111000126866",

"Items": [

{

"ItemSeq": 1,

"ItemName": "item01",

"ItemCount": 1,

"ItemWord": "test",

"ItemPrice": 50,

"ItemTaxType": "1",

"ItemAmount": 50,

"ItemRemark": "item01_desc"

},

{

"ItemSeq": 2,

"ItemName": "item02",

"ItemCount": 1,

"ItemWord": "test",

"ItemPrice": 20,

"ItemTaxType": "1",

"ItemAmount": 20,

"ItemRemark": "item02_desc"

},

{

"ItemSeq": 3,

"ItemName": "item03",

"ItemCount": 3,

"ItemWord": "test",

"ItemPrice": 10,

"ItemTaxType": "1",

"ItemAmount": 30,

"ItemRemark": "item03_desc"

}

],

"RtnCode": 1,

"RtnMsg": "Success"

}

YAML

The provided YAML file is used to define the configuration, structure, operations, and infrastructure management information of the API, making it easier for developers to understand and use the API.

openapi: 3.1.0

info:

title: ECPay Query Invoice Details API

version: 1.0.0

servers:

- url: https://einvoice-stage.ecpay.com.tw

description: Testing Environment

- url: https://einvoice.ecpay.com.tw

description: Production Environment

paths:

/B2CInvoice/GetIssue:

post:

summary: Query Invoice Details

requestBody:

required: true

content:

application/json:

schema:

type: object

required:

- MerchantID

- RqHeader

- Data

properties:

PlatformID:

type: string

maxLength: 10

description: Platform ID for partnered platforms

MerchantID:

type: string

maxLength: 10

description: Merchant ID

RqHeader:

type: object

required:

- Timestamp

properties:

Timestamp:

type: integer

description: Unix timestamp (GMT+8)

Data:

type: string

description: Encrypted data containing request details

responses:

'200':

description: Successful Response

content:

application/json:

schema:

type: object

properties:

PlatformID:

type: string

maxLength: 10

description: Platform ID for partnered platforms

MerchantID:

type: string

maxLength: 10

description: Merchant ID

RpHeader:

type: object

properties:

Timestamp:

type: integer

description: Unix timestamp (GMT+8)

TransCode:

type: integer

description: Transmission code

TransMsg:

type: string

maxLength: 200

description: Transmission message

Data:

type: string

description: Encrypted data containing response details

components:

schemas:

requestBody.Data:

type: object

required:

- MerchantID

- RelateNumber

- InvoiceNo

- InvoiceDate

properties:

MerchantID:

type: string

maxLength: 10

description: Merchant ID

InvoiceNo:

type: string

description: Invoice number

InvoiceDate:

type: string

format: date

description: Invoice date (yyyy-MM-dd or yyyy/MM/dd)

RelateNumber:

type: string

maxLength: 30

description: Unique merchant number

responses.Data:

type: object

properties:

RtnCode:

type: integer

description: Response code

RtnMsg:

type: string

maxLength: 200

description: Response message

IIS_Mer_ID:

type: string

maxLength: 10

description: Merchant ID

ChannelPartner:

type: string

maxLength: 1

description: Channel partner ID

IIS_Number:

type: string

maxLength: 10

description: Invoice number

IIS_Relate_Number:

type: string

maxLength: 30

description: Merchant-defined unique number

IIS_Customer_ID:

type: string

maxLength: 20

description: Customer ID

IIS_Identifier:

type: string

maxLength: 10

description: Customer identifier

IIS_Customer_Name:

type: string

maxLength: 60

description: Customer name

IIS_Customer_Addr:

type: string

maxLength: 100

description: Customer address

IIS_Customer_Phone:

type: string

maxLength: 20

description: Customer phone

IIS_Customer_Email:

type: string

maxLength: 80

description: Customer email

IIS_Clearance_Mark:

type: string

maxLength: 1

description: Clearance mark

IIS_Type:

type: string

maxLength: 2

description: Invoice type

IIS_Category:

type: string

maxLength: 10

description: Invoice category

IIS_Tax_Type:

type: string

maxLength: 1

description: Tax type

SpecialTaxType:

type: integer

description: Special tax type

IIS_Tax_Rate:

type: number

description: Tax rate

IIS_Tax_Amount:

type: number

description: Tax amount

IIS_Sales_Amount:

type: number

description: Sales amount

IIS_Check_Number:

type: string

maxLength: 4

description: Check number

IIS_Carrier_Type:

type: string

maxLength: 1

description: Carrier type

IIS_Carrier_Num:

type: string

maxLength: 64

description: Carrier number

IIS_Love_Code:

type: string

maxLength: 7

description: Donation code

IIS_IP:

type: string

maxLength: 20

description: Invoice issuance IP

IIS_Create_Date:

type: string

description: Invoice creation date

IIS_Issue_Status:

type: string

maxLength: 1

description: Invoice issuance status

IIS_Invalid_Status:

type: string

maxLength: 1

description: Invoice invalidation status

IIS_Upload_Status:

type: string

maxLength: 1

description: Invoice upload status

IIS_Upload_Date:

type: string

description: Invoice upload date

IIS_Turnkey_Status:

type: string

maxLength: 1

description: Turnkey status

IIS_Remain_Allowance_Amt:

type: number

description: Remaining allowance amount

IIS_Print_Flag:

type: string

maxLength: 1

description: Print flag

IIS_Award_Flag:

type: string

maxLength: 1

description: Award flag

IIS_Award_Type:

type: string

maxLength: 2

description: Award type

Items:

type: array

items:

type: object

required:

- ItemSeq

- ItemName

- ItemCount

- ItemWord

- ItemPrice

- ItemAmount

properties:

ItemSeq:

type: integer

description: Item sequence number

ItemName:

type: string

maxLength: 100

description: Item name

ItemCount:

type: number

description: Item quantity

ItemWord:

type: string

maxLength: 6

description: Item unit

ItemPrice:

type: number

description: Item unit price

ItemTaxType:

type: string

maxLength: 1

description: Item tax type

ItemAmount:

type: number

description: Item total amount

ItemRemark:

type: string

maxLength: 40

description: Item remark

IIS_Random_Number:

type: string

maxLength: 4

description: Random number

InvoiceRemark:

type: string

maxLength: 200

description: Invoice remark

PosBarCode:

type: string

description: Barcode for electronic invoice

QRCode_Left:

type: string

description: Left QR code for electronic invoice

QRCode_Right:

type: string

description: Right QR code for electronic invoice

Illustration and Description of the E-Invoice QR Code